Here we have explained about National Pension System. We discussed everything in detail.

- About NPS

- Eligibility & Procedure

- Who needs it?

- Returns

- Options & Tax Benefits

- Conclusion

About NPS

- National Pension System is a govt scheme.

- NPS launched in the first month of 2004 for government employees.

- NPS opened to the public people in 2009. Now any person can join this pension scheme during their working life.

- The National Pension Scheme is a specialized division of the Pension Fund Regulatory and Development Authority, which answers to the Ministry of Finance of the Indian government.

- It is a voluntary Retirement scheme.

Background of NPS

If a young person invests in this pension scheme, he will receive a monthly pension income from the government of India after 60 years.

Simply NPS is similar to hybrid mutual funds.

For example,

HDFC balanced advantage fund,

ICICI prudential equity & debt fund,

Canara bank equity hybrid fund.

There are numerous hybrid equity funds very similar to the National pension scheme.

Usually, we invest in PPF, FD, and RD but receive low returns; however, Because of the presence of equities, investing in this NPS scheme will result in higher returns (10% -12%).

So it is capable of overcoming inflation.

NPS Eligibility

Any Indian citizen (resident or non-resident)

Should be the age between 18 to 60 years old at the time of joining can join in the NPS scheme.

Who needs it?

Any salaried individual earning more than 7,50,000 will require this NPS scheme.

For example:

Here there is a 5% tax for 240000 is 12000. But as per sec 87A, net taxable income is below 5,00,000. Our govt will refund that amount. So there is No Income tax.

Hence an individual Earning less than 750,000 per year, NPS is not required.

If your annual salary exceeds 8 or 8.5 lakhs, NPS will save you money on taxes.

Returns

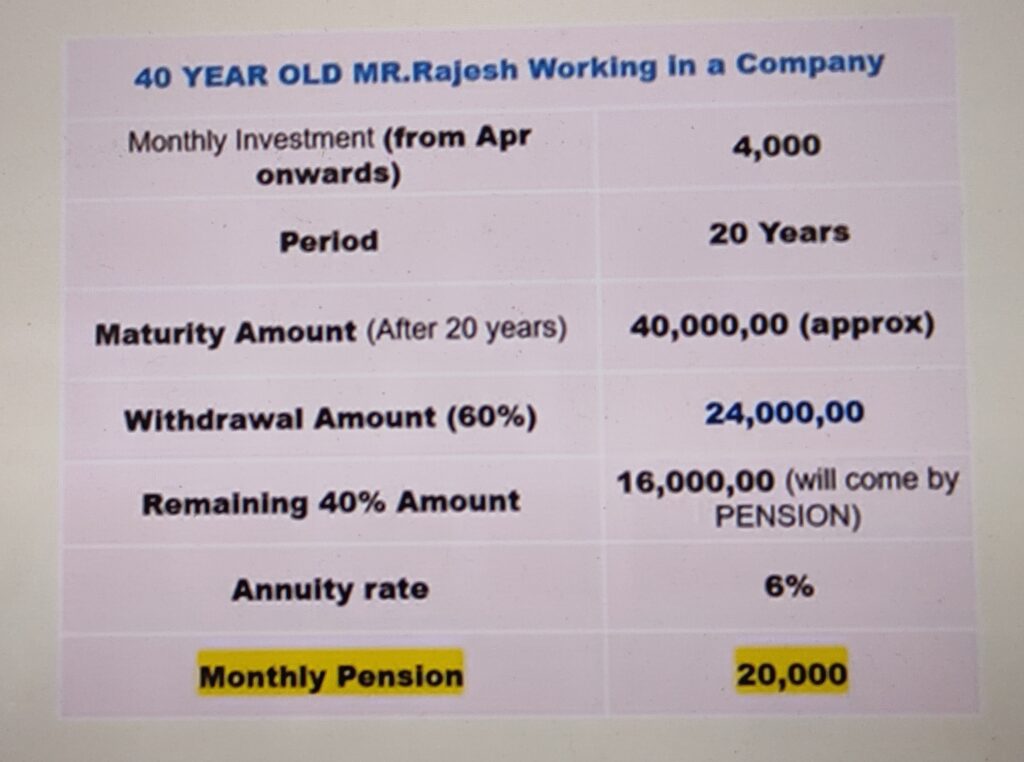

Finally, the question is: How much pension will I receive from investing in the NPS Scheme?

We cannot withdraw before you reach the age of 60, and once you reach the age of 60, you can Withdraw only 60% of the maturity amount, which is 24 lakhs.

Balance The monthly pension will bring in 16 lakhs.

If you invest 4,000 each month now, you will receive a monthly pension income of 20,000 after 60 years of your age.

If a person dies at that time, the remaining 16 lakhs will given to the nominee.

The future monthly pension will determined by the Annuity rate(interest).

Here we estimated this using a 6% Annuity rate.

Who is the Fund Manager & what is the procedure in the NPS scheme?

Who is the Fund Manager?

This is managed by seven fund managers.

SBI, LIC, ICICI Prudential, ABSL,UTI, HDFC, and Kotak

They manage the funds, While the records are managed by NSDL & KFINTECH PRAN.

Procedure in the NPS scheme:

Through this procedure, we will invest the amount in it.

This NSDL and KFINTECH will monitor the procedure and backend work.

When registering with NSDL, they will provide a PRAN number, similar to the PAN and Folio numbers provided by mutual funds.

This PRAN number used to route our investment.

There is just one PRAN number for one person, and it comes with all your information.

There are two types of PRAN:

E-PRAN and

Physical PRAN (recommended)

because If he is not present at the time, their family can easily track the details of this investment.

Options (available in NPS)

Here there are two investment choices:

Active choice (recommended)give it

Auto Choice

A hybrid equity mutual fund is NPS. We can select an allocation between equity,

corporate debt,

government bonds, and

alternative investment options in this (ex) Option for investing in real estate.

However, our suggestions are as follows:

75% equity

15% corporate debt

Government Debt – 10%

If you are interested, you can include an alternate Investment fund(5%).

The active choice is better for getting good returns.

TYPES OF ACCOUNTS:

There are two types of NPS:

Tier 1

It is a retirement account.

It is an additional investment choice of 80c and receives a tax benefit of 80ccd, which is 50,000 per year.

It has a lock-in period, we cannot withdraw before you reach the age of 60, and once you reach the age of 60, you can Withdraw only 60% of the maturity amount.

Tier 2

It is comparable to an open-ended scheme having no restriction in part of allocation & we can also withdraw at any time and will consider the year income & tax will calculate as per tax slab.

We can only open tier 2 accounts if we open tier 1 accounts and keep them active.

NPS – Tax Benefits

The tax benefit of section 80c is well-known to salaried individuals and business owners. We can show insurance, PF, and ELSS plan investments similar to this housing loan in 80c.

Tax deductions up to 2 lakhs/FY

Sec 80C = 1.5 Lakhs

Sec 80CCD (1B) = Additional 50,000

You can claim 1.5 lakhs under Section 80 C and an extra 50,000 under Section 80 CCD, therefore if your investment is two lakhs or more, you can claim tax savings under these two sections (here you can get an additional 50,000 tax benefit)

After you turn 60,

60% of the maturity amount is tax-free, but pension income is taxable according to tax slabs.

How to Register NPS?

Online

or

Physical

NPS registration is available both physically and online.

If you want to apply online, go to the CAMS or KFINTECH websites and fill out an NPS application.

Important: Your mobile number must linked with your Aadhaar, and your name must be the same as your PAN, Aadhaar, and bank account number.

Softcopy of your signature,

A soft copy of your passport-size photo and a canceled cheque leaf copy is required.

If online is not comfortable for you

If you want to apply in person, go to a state bank or a post office. They will give you a physical form and assist you with the process.

The post office is our advice because it is everywhere.

Conclusion:

Finally, why should you invest in an NPS plan?

Invest 50,000 each year to receive an additional tax benefit under Section 80ccd and to meet your retirement goals.

We have a 15, 20-year retirement horizon, and while investing in these hybrid funds does not provide greater returns, it provides somewhat better returns when compared to traditional investments.

If you want to build a strong retirement portfolio in the long run, split one half for NPS tax savings and balance – diversify your amount in equity mutual funds – you will build good wealth.